An Unbiased View of Estate Planning Attorney

An Unbiased View of Estate Planning Attorney

Blog Article

The Facts About Estate Planning Attorney Uncovered

Table of ContentsEstate Planning Attorney for BeginnersAn Unbiased View of Estate Planning AttorneyThe Greatest Guide To Estate Planning AttorneyThe Definitive Guide for Estate Planning Attorney

Estate planning is an action plan you can use to determine what happens to your possessions and responsibilities while you're alive and after you die. A will, on the other hand, is a lawful record that outlines just how properties are dispersed, who looks after children and animals, and any other wishes after you pass away.

The administrator additionally needs to pay off any tax obligations and financial debt owed by the deceased from the estate. Creditors typically have a restricted quantity of time from the day they were alerted of the testator's fatality to make claims against the estate for money owed to them. Claims that are denied by the executor can be taken to court where a probate court will certainly have the last word as to whether or not the claim stands.

Estate Planning Attorney for Dummies

After the supply of the estate has actually been taken, the value of assets determined, and tax obligations and financial obligation paid off, the administrator will certainly then seek authorization from the court to disperse whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will certainly come due within 9 months of the date of death.

Each individual areas their properties in the depend on and names someone various other than their partner as the beneficiary., to sustain grandchildrens' education and learning.

All about Estate Planning Attorney

This technique includes cold the value of an asset at its worth on the date of transfer. Appropriately, the quantity of possible capital gain at death is likewise iced up, allowing the estate coordinator to approximate their possible tax obligation liability upon death and much better prepare for the settlement of earnings tax obligations.

If enough insurance proceeds are offered and the policies are effectively structured, any income tax on the deemed dispositions of assets following the death of a person can be paid without considering the sale of properties. Profits from life insurance policy that are received view publisher site by the recipients upon the fatality of the guaranteed are normally income tax-free.

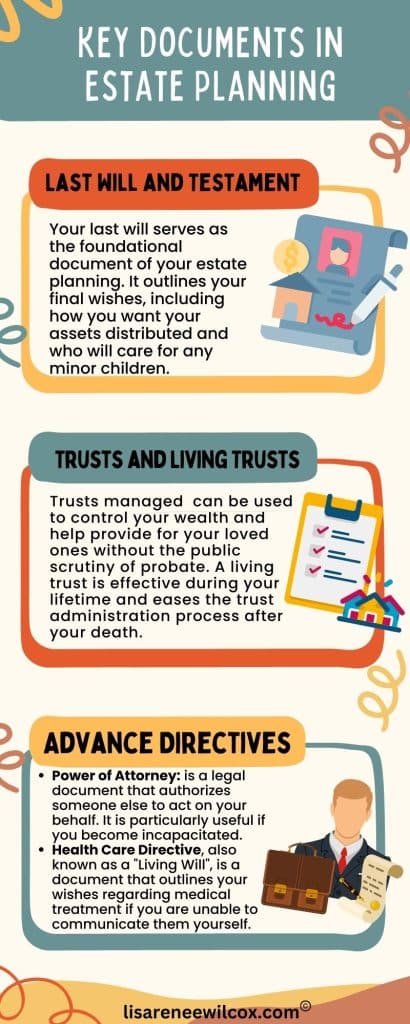

There are certain documents you'll require as component of the estate planning click here for more info process. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is only for high-net-worth people. Estate planning makes it easier for people to identify their wishes prior to and after they die.

Estate Planning Attorney Can Be Fun For Anyone

You ought to begin intending for your estate as soon as you have any type of quantifiable property base. It's an ongoing procedure: as life proceeds, your estate plan ought to change to match your circumstances, according to your new objectives. And keep at it. Not doing your estate planning can trigger unnecessary economic burdens to enjoyed ones.

Estate planning is often believed of as a tool for the rich. Estate planning is likewise an excellent method for you to lay out strategies for the treatment of your small kids and animals and to outline your wishes for your funeral service and favored charities.

Qualified candidates that pass the examination will certainly be formally licensed in August. If you're eligible to sit for the test from a previous application, you might submit the brief application.

Report this page